What Are the Lyft and Uber Auto Requirements and Laws in North Hollywood, CA?

August 15, 2025 – Sean Shamsi

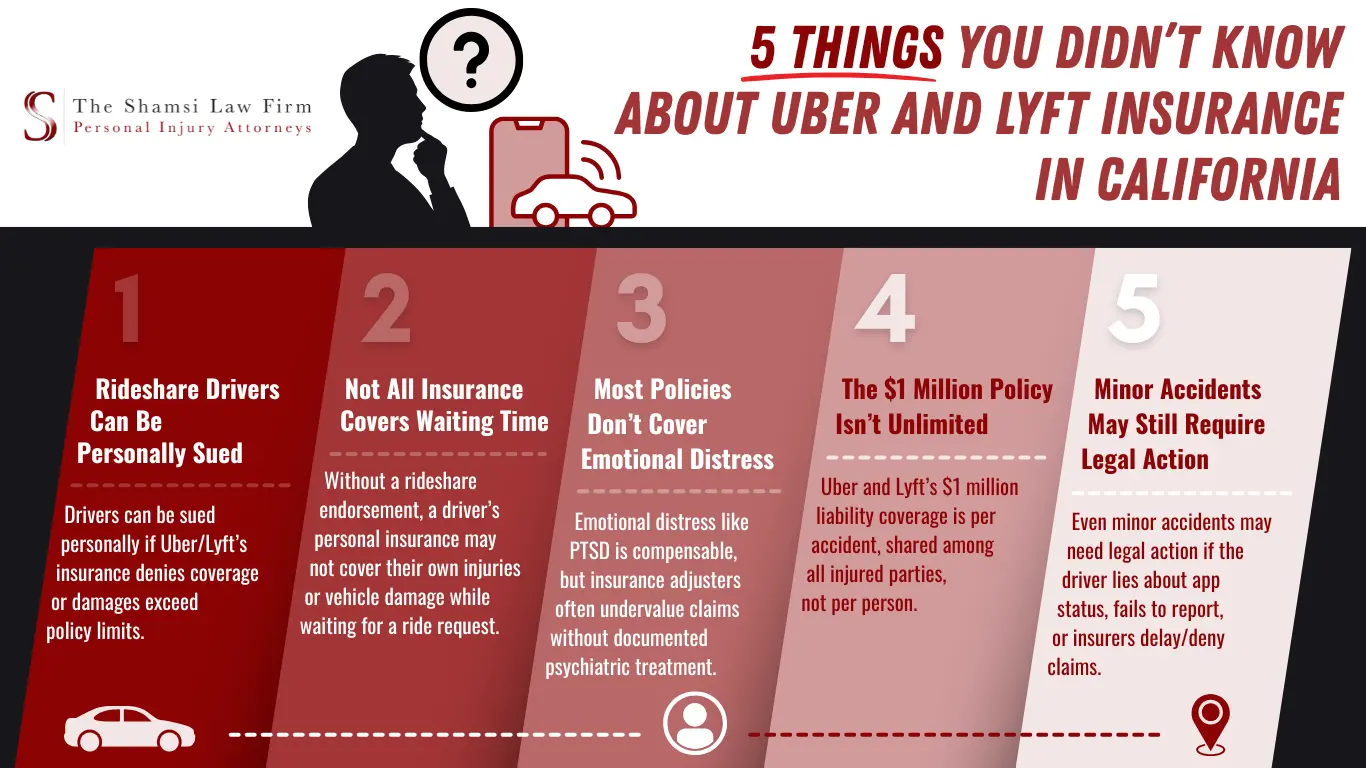

You trusted the driver to get you there safely. Instead, you’re left with medical bills, unanswered questions, and an insurance company trying to avoid responsibility. Whether you were injured as a passenger, hit by a rideshare driver, or driving for Uber or Lyft yourself, the legal rules in California can feel overwhelming. But you don’t have to sort it all out alone.

In this blog, we’ll break down how California law treats Lyft and Uber auto requirements, what insurance coverage applies depending on when the accident occurred, and how these rules affect your ability to file a personal injury claim. If you were hurt in a rideshare accident, this is what you need to know before moving forward.

California Treats Uber and Lyft Drivers Differently Than Traditional Employees

Most people assume that companies like Lyft and Uber are responsible for their drivers at all times. That’s not always the case in California. Rideshare drivers are generally classified as independent contractors, not employees. This distinction affects everything from benefits to liability when an accident happens.

Under California Assembly Bill 5 (AB 5) and its amendment AB 2257, rideshare drivers could have been reclassified as employees. But in November 2020, Proposition 22 passed, exempting app-based rideshare and delivery companies from that rule. As of 2025, Prop 22 remains in effect, which means:

- Uber and Lyft drivers are not employees under California law

- The companies are not automatically liable for accidents unless specific conditions are met

Lyft and Uber Auto Requirements for Drivers in California

To drive for a rideshare company in California, Uber and Lyft drivers must meet certain vehicle and insurance requirements. The rules vary depending on whether the driver is logged into the rideshare app and whether a ride has been accepted.

Vehicle Requirements for Rideshare Drivers

Uber and Lyft each set their own standards for vehicle eligibility, but in general, the rideshare vehicle must:

- Be a four-door car, truck, or minivan in good condition

- Pass a 19-point vehicle inspection

- Be newer than 15 years old (in most cities)

- Have valid California license plates and registration

The rideshare app may also require documentation showing regular maintenance and valid insurance.

What Insurance Covers a Rideshare Accident in California?

One of the most confusing parts of a rideshare accident is figuring out whose insurance applies. Whether you were a passenger, a pedestrian, or another driver on the road, the coverage depends on the rideshare driver’s status in the app at the time of the crash.

California recognizes three official insurance coverage periods for rideshare drivers, but there’s also a fourth, unofficial phase when the driver is offline. Here’s how it works:

When the Driver Is Offline (Personal Use)

If the driver hasn’t turned on the Uber or Lyft app, they’re considered offline and using the car for personal reasons. In this phase:

- Uber and Lyft are not liable

- The driver’s personal auto insurance applies exclusively

- You may still file a claim, but only through the driver’s own policy

The California Public Utilities Commission (CPUC) does not formally define this as one of the three rideshare coverage periods, but it is widely accepted by insurers and courts as a distinct phase of personal liability.

Period 1: App On, No Ride Accepted

This is the period when the driver has the Uber or Lyft app on but hasn’t accepted a ride request yet. If you’re a passenger, make sure your driver has the app active before the ride begins. If the app isn’t on, coverage may drop significantly, or not apply at all.

- Uber and Lyft provide limited third-party liability coverage

- $50,000 for bodily injury per person

- $100,000 total per accident

- $30,000 in property damage liability coverage

- No coverage for the rideshare driver’s own injuries or vehicle unless their personal policy has a rideshare endorsement

Periods 2 and 3: Ride Accepted or Passenger in Vehicle

Uber and Lyft provide commercial auto insurance during these phases:

- $1 million in third-party bodily injury liability coverage

- $1 million in uninsured/underinsured motorist coverage

- Contingent collision and comprehensive coverage (if the driver carries it personally)

These apply from the moment a ride is accepted until the passenger exits the vehicle.

What to Do After an Accident Involving an Uber or Lyft in Los Angeles

If you’re involved in a rideshare accident in Los Angeles or anywhere in California, your actions at the accident scene can affect your case.

Take these steps when possible:

- Contact law enforcement and ask for a police report

- Get the rideshare driver’s name, license plate, and app status (online/offline)

- Take photos of the vehicles, injuries, road conditions, and any damage

- Gather contact info for any witnesses

- See a doctor right away, even if you think you’re okay. Adrenaline can mask pain, and some injuries aren’t obvious right after a crash

- Call your attorney before contacting Uber or Lyft. Your attorney can notify the rideshare company for you and help protect your case from the start

These steps apply whether you’re a rideshare passenger, pedestrian, cyclist, or another driver.

How Insurance Companies Complicate Rideshare Accident Claims

Insurance companies may argue about whose coverage applies, how much is owed, or whether you were partially at fault. In many cases, they try to limit your recovery or claim the accident occurred outside coverage hours.

Common insurance tactics include:

- Blaming the rideshare driver’s personal insurance even when the app was active

- Downplaying your injuries or saying they were pre-existing

- Arguing about the status of the rideshare app at the moment of the crash

- Delaying payouts by demanding endless documentation

If you’re an accident victim hurt by an Uber or Lyft driver, or you were driving for the app and hit by someone else, these insurance issues can affect how much you receive for medical bills, property damage, and long-term losses.

Filing a Personal Injury Claim After a Rideshare Accident

To recover compensation, you may need to file a personal injury claim against:

- The at-fault rideshare driver

- Uber or Lyft, if the driver was logged in and a ride was active

- Another at-fault driver, pedestrian, or cyclist

- Your own personal auto insurance, if the other party is uninsured or underinsured

California allows you to recover for:

- Medical expenses (hospital stays, rehab, medications)

- Lost wages and reduced earning capacity

- Pain and suffering

- Property damage to your vehicle

- Emotional trauma or PTSD

In some cases, your claim may escalate to a personal injury lawsuit. This is more common when the rideshare company disputes coverage, or when damages exceed the insurance policy limits.

Lyft and Uber Accident Cases Involving Multiple Parties

In rideshare accidents, multiple parties may share responsibility. This can include:

- The Uber or Lyft driver

- Another motor vehicle involved

- The rideshare company (if negligence in hiring or safety protocols is shown)

- A vehicle or part manufacturer (in defective vehicle cases)

If fault is shared, California follows pure comparative fault rules under California Civil Code § 1431.2. This means you can still recover compensation even if you were partially at fault, your award will just be reduced by your percentage of fault.

Why Uber and Lyft Insurance Rules Matter for Rideshare Drivers

If you drive for Uber or Lyft, understanding your own insurance coverage matters just as much as it does for passengers.

Here’s what you need to know:

- Your personal insurance won’t cover you when you’re logged into the app unless you carry rideshare endorsements

- Uber and Lyft’s policies only apply when you’re on the app and actively working

- If your accident occurred while driving to pick someone up or during a ride, you may be covered by the $1 million policy

- If you were hit by another driver while waiting for a ride request, your medical and vehicle damage may fall into a gray area

Many rideshare drivers assume Uber or Lyft will handle everything. In reality, those companies often deny claims unless you meet very specific conditions.

Can You Sue Uber or Lyft Directly?

In most cases, you will file a rideshare accident claim through insurance. But there are situations where you may be able to pursue legal action against Uber or Lyft directly.

This could happen if:

- The company failed to properly screen a driver with a dangerous record

- The rideshare app had a defect that contributed to the crash

- You’re able to show the company acted negligently beyond standard insurance disputes

These lawsuits are rare, but they do happen and they often involve higher damages.

Do Time Limits Apply to Uber or Lyft Accident Claims?

Yes. Under California Code of Civil Procedure § 335.1, you typically have two years from the date of the accident to file a lawsuit. There are exceptions, such as when a government vehicle is involved or the victim is a minor. But missing the deadline can cost you your ability to file at all.

Frequently Asked Questions

Q: Can a rideshare passenger be held liable for an accident?

A: Generally, no. If you were riding in an Uber or Lyft and the driver caused the crash, you are considered a third-party victim. However, if a passenger somehow interfered with the operation of the vehicle, such as grabbing the steering wheel or assaulting the driver—there could be liability. These cases are rare.

Q: What happens if a rideshare driver hits a bicyclist or pedestrian?

A: If the driver was actively using the app when the accident occurred, Uber or Lyft’s insurance coverage may apply. That includes up to $1 million in third-party liability. The injured cyclist or pedestrian can file a personal injury claim just as they would in a typical car accident case.

Q: Does it matter if the Uber or Lyft driver was using their personal car?

Most rideshare drivers use their own vehicles. What matters legally is whether they were logged into the app and whether they accepted a ride request. The type of car doesn’t change how insurance coverage is applied under California law.

Q: Are rideshare drivers required to carry special insurance?

Yes. California requires rideshare drivers to carry a personal policy with specific endorsements or purchase rideshare-specific insurance. Driving for Uber or Lyft without disclosing it to your insurance provider can lead to a denial of coverage if an accident occurs.

Q: Can I file a claim if the rideshare accident aggravated a pre-existing injury?

A: Yes. California personal injury law allows you to recover compensation if the crash worsened an existing condition, such as a prior back injury or joint damage. You’ll need solid medical records and expert documentation to show the extent of the new harm.

Q: Do Uber and Lyft monitor driver safety records?

A: Yes, both companies claim to run background checks and annual safety screenings. However, these systems aren’t perfect. There have been instances where drivers with prior violations were allowed on the platform, which can open the door for negligent hiring claims.

Q: What if the driver didn’t report the accident to Uber or Lyft?

Even if the rideshare driver fails to report the crash, you can still notify the company yourself using their in-app reporting tools or customer support. It’s important to create a paper trail. If you wait too long, it may be harder to get the company involved or access their insurance coverage.

Injured in an Uber or Lyft Accident? Work With a Law Firm That Fights for You

At The Shamsi Law Firm, APC, we represent car accident victims across Southern California, including those injured in Uber and Lyft crashes in Los Angeles County, North Hollywood, Long Beach, Burbank, and beyond. Whether you were a passenger, another driver, or a rideshare driver yourself, we’re ready to investigate what happened and hold the right party accountable.

Our personal injury law firm focuses on cases involving motor vehicle accidents, rideshare accident claims, and complex disputes over insurance coverage. From broken bones to brain trauma, we know how to document your injuries and challenge lowball offers.

Your case matters. We offer a free consultation, and you pay nothing unless we win. If you’re looking for a Lyft accident lawyer or Uber injury lawyer, who understands how these cases work in California, start by calling us. We fight the insurance companies so you don’t have to.

Call (818) 764-7640(818) 764-7640 or fill out our confidential online form to speak with a rideshare injury lawyer today.

We’re here to support your recovery and protect your legal rights every step of the way.

Copyright © 2025. The Shamsi Law Firm, APC. All rights reserved.

The information in this blog post (“post”) is provided for general informational purposes only and may not reflect the current law in your jurisdiction. No information in this post should be construed as legal advice from the individual author or the law firm, nor is it intended to be a substitute for legal counsel on any subject matter. No reader of this post should act or refrain from acting based on any information included in or accessible through this post without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue from a lawyer licensed in the recipient’s state, country, or other appropriate licensing jurisdiction.

The Shamsi Law Firm, APC

13209 Saticoy St.

North Hollywood, CA 91605

(818) 764-7640(818) 764-7640

https://www.shamsilaw.com/

No Fee Unless You Win

Questions or Schedule An Appointment? Call Us: (818) 764-7640

Questions or Schedule An Appointment? Call Us:

(818) 764-7640

Related Blog Posts

We Will Fight For You

Our Locations

North Hollywood Office

Get DirectionsAre you struggling and need help from a lawyer? Contact us for a free consultation.

Get a Free Consultation

Required Fields*

Your Information Is Safe With Us

By submitting, you agree to receive text messages at the provided number from The Shamsi Law Firm . Message frequency varies, and standard message and data rates may apply. You have the right to OPT-OUT receiving messages at any time. To OPT-OUT, reply “STOP” to any text message you receive from us. Reply HELP for assistance.

We respect your privacy. The information you provide will be used to answer your question or to schedule an appointment if requested.