What You Need to Know About Filing a State Farm Claim After a Car Accident in North Hollywood

October 15, 2025 – Sean Shamsi

A car crash in Los Angeles County can change everything in seconds. One moment you’re driving through North Hollywood or merging onto the 101, and the next you’re rear-ended by a distracted driver. Suddenly, you’re left with injuries, car damage, and the stress of missing work while bills start piling up.

Car accident victims often assume that filing an insurance claim is a simple matter. In reality, the process can be slow and frustrating, with adjusters trained to limit payouts and protect the company’s bottom line. State Farm, as one of the largest auto insurers in California, handles thousands of claims every year. For many drivers in North Hollywood and across Los Angeles County, this means dealing directly with State Farm after a crash.

This blog explains what you need to know about filing a State Farm claim after a car accident in North Hollywood. We’ll cover how California’s fault-based insurance system works, what coverages may apply under your policy, and what to expect when it comes to reporting the crash, handling repairs, dealing with adjusters, and negotiating a settlement.

Steps to Take After a Car Accident

What you do in the first moments of a crash can shape the entire claims process. Taking the time to document the scene, get medical care, and gather key details gives you the proof you need if the insurance company later tries to dispute fault or minimize your losses.

Call Law Enforcement

Under California Vehicle Code § 20008, you must report any accident that causes injury or death to the local police or the California Highway Patrol within 24 hours. If officers respond to the scene, they will prepare a traffic collision report. This report provides details that are often critical when pursuing a car accident claim.

Seek Medical Attention

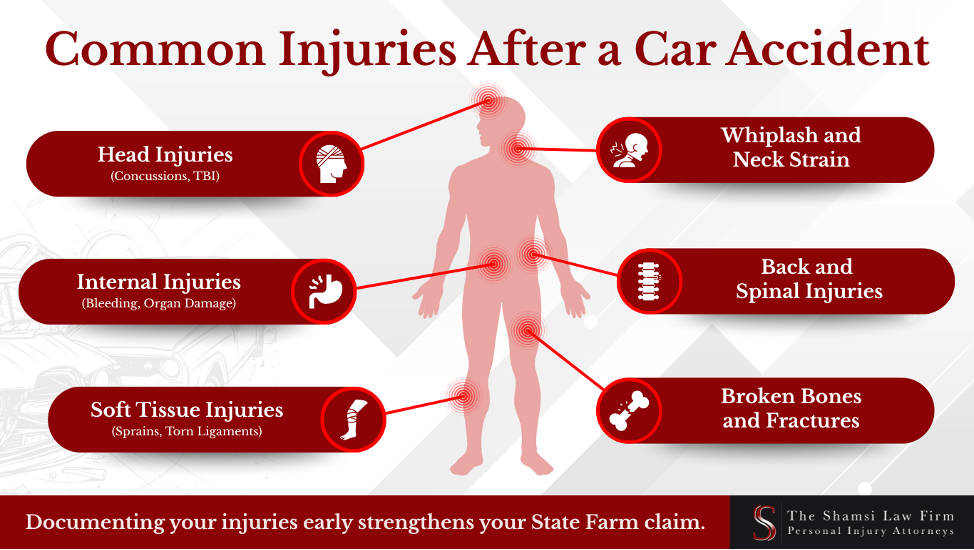

Even if your injuries seem minor and you “feel fine,” seek medical attention right away. Many car accident injuries, such as concussions, soft tissue damage, or internal bleeding, may not appear until hours later. Documenting medical treatment right away helps connect your injuries to the crash. Medical records become vital evidence in your personal injury case.

Exchange Insurance Information

California law requires drivers to exchange names, addresses, and insurance information at the accident scene. Make sure you also record license plate numbers and the other driver’s contact details.

Collect Witness Statements

Independent witnesses often provide unbiased accounts of how the accident occurred. If you’re able, collect their names, phone numbers, and email addresses before they leave.

Photograph the Scene

Take clear photos and video of:

- Vehicle collisions and damage

- Traffic signals and road signs

- Skid marks or debris on the road

- Visible injuries

File a DMV Report if Required

California also requires drivers to file a Report of Traffic Accident Occurring in California (SR-1) with the DMV within 10 days if the crash caused injury, death, or more than $1,000 in property damage (Cal. Veh. Code § 16000). Failure to file can lead to license suspension.

This evidence strengthens your claim if fault is disputed. With these details collected, the next step is notifying State Farm.

Reporting the Accident to State Farm

With the basic information from the scene in hand, your next step is reporting the crash to State Farm. Before you pick up the phone or log in online, it helps to know which type of claim you’re filing.

California is a fault state. That means the driver who caused the accident and their insurer are generally responsible for the damages. How you file depends on your situation:

- Third-party claim: If the negligent driver is insured by State Farm, you’ll file against their liability policy. This is usually the main way to recover for medical bills, lost wages, and property damage.

- First-party claim: If you have a State Farm policy yourself, you may also turn to your own coverage. For example, collision coverage can pay for repairs right away, or MedPay can cover immediate medical bills. Later, State Farm may seek reimbursement from the at-fault driver’s insurer through subrogation.

Example: You’re rear-ended in North Hollywood. The other driver’s insurer drags its feet. Instead of waiting, you use your own collision coverage so your car gets repaired quickly. State Farm pays the shop, then pursues the other driver’s insurer for reimbursement. If successful, your deductible may be refunded.

Coverages That May Apply

- Collision coverage – Repairs or replaces your vehicle regardless of fault. Optional, but often required if your car is financed or leased.

- Medical Payments (MedPay) – Optional add-on. Pays ambulance, ER, surgery, therapy, or funeral costs for you and your passengers, regardless of fault. Typically capped at modest limits ($1,000–$10,000). If you later recover money from the other insurer, State Farm may ask for repayment of what it covered.

- Uninsured/Underinsured Motorist (UM/UIM) – Steps in when the at-fault driver has no coverage or not enough. Required to be offered in California, but you can decline it in writing.

When you know what type of claim you’re filing and which coverages may help, you’re ready to report the accident to State Farm.

How to Report a Claim

- Online: File through State Farm’s website and upload supporting documents.

- Mobile App: Submit photos, repair estimates, and medical records directly from your smartphone.

- Phone: Call the customer service number listed on your insurance card or the company’s website.

Dealing With the Claims Adjuster

When you report your car accident, State Farm assigns an adjuster to your case. The adjuster will review the police report, speak with witnesses, inspect vehicle damage, and analyze your medical documentation. While you should cooperate with reasonable requests, remember that the adjuster works for State Farm, not for you.

You may be asked for:

- A description of how the accident occurred

- Details of your car accident injuries and medical treatment

- Copies of medical records and bills

- Proof of lost wages or employment disruption

- Vehicle repair estimates and photographs

Recorded Statements

Adjusters often ask for recorded statements. These can be risky because they may later be used against you. Always consult a personal injury attorney before agreeing to a recorded interview.

Medical Records

While insurers are entitled to records related to the crash, they sometimes request broad access to your entire medical history. This can lead to disputes over whether your injuries were caused by the accident or by pre-existing conditions. Work with auto accident attorneys to limit disclosure to what is relevant.

When the adjuster has the information needed to open your file, they will also address your property damage claim, including repairs, total loss, and rental coverage.

Handling Vehicle Repairs and Property Damage

When you report the accident, State Farm will also open a property damage claim for your vehicle. An adjuster may inspect your car in person or review photos to determine whether it can be repaired or is a total loss.

- Repairs: If your car is repairable, State Farm will typically issue payment directly to the repair shop or reimburse you after repairs are complete. In California, you have the legal right to choose your own repair shop. While State Farm may recommend one of its preferred repair facilities, you are not required to use it. The insurer must still cover reasonable and necessary repairs needed to restore your vehicle to its pre-accident condition, up to your policy limits.

- Total Loss: If your car is declared a total loss, State Farm will calculate the vehicle’s actual cash value (ACV) at the time of the accident. Disagreements sometimes arise over ACV, particularly with newer or well-maintained vehicles. You may contest a valuation if you believe it does not reflect your car’s fair market value.

- Rental Cars: If your policy includes rental reimbursement coverage, State Farm will pay for a rental car while your vehicle is being repaired or replaced. If you don’t have this coverage, rental costs are generally your responsibility, although in some cases you may seek reimbursement from the at-fault driver’s liability policy.

While the property damage portion of a claim is often resolved first, settlement negotiations over medical expenses and other losses typically take longer and involve more back-and-forth with the insurer.

Negotiating a Settlement with State Farm

Once liability has been established and you’ve submitted documentation of your losses, State Farm will typically make a settlement offer. These initial offers are rarely enough to cover the full extent of your damages.

What Can Be Included in a Settlement

A settlement may cover:

- Economic damages: Medical expenses, lost wages, property damage, and other direct costs.

- Non-economic damages: Pain and suffering, emotional distress, and loss of enjoyment of life.

- Future damages: Ongoing medical care, rehabilitation, and diminished earning capacity.

How Fault Affects Compensation

California applies a pure comparative negligence standard under Cal. Civ. Code § 1714. Even if you were partly at fault for the accident, such as being rear-ended while slowing suddenly or contributing to a distracted driving crash, you may still recover compensation. Your potential award would simply be reduced by your percentage of fault.

Responding to Low Offers

State Farm’s first offer is often too low. You can make a counteroffer by providing documentation such as:

- Hospital and rehabilitation records

- Pay stubs or tax returns showing lost income

- Expert evaluations for long-term treatment needs

Even during these talks, it’s common for insurers to delay, shift blame, or argue about medical treatment. Knowing these tactics makes it easier to stay firm in your negotiations.

Common Insurance Company Tactics

State Farm is one of the largest insurers in the country, and its adjusters are well-trained in strategies that limit payouts. Accident victims across Southern California often face:

- Low settlement offers. Designed to pressure you into accepting less than your case is worth.

- Delays. Long processing times can make clients desperate for funds.

- Blame-shifting. Allegations of reckless driving, tailgating, or distracted driving by the victim.

- Disputing medical necessity. Arguing that certain treatments are excessive or unrelated to the crash.

- Surveillance. In some cases, insurers hire investigators to monitor claimants and dispute injury severity.

Recognizing these tactics makes it easier to anticipate the insurance provider’s moves and protect your legal rights.

When to Contact a Personal Injury Attorney

Not every State Farm claim requires an attorney, but some situations are too complex or high-stakes to handle on your own. In those cases, California law gives you the option of filing a lawsuit or pursuing other remedies if the insurance process breaks down.

Situations that often call for contacting a personal injury attorney in North Hollywood include:

- Catastrophic injuries. Brain trauma, spinal cord injuries, or multiple surgeries that lead to high medical expenses.

- Wrongful death. Families may file a personal injury lawsuit under Cal. Code Civ. Proc. § 377.60 when a loved one dies due to someone else’s negligence.

- Disputed liability. Multi-vehicle collisions, rideshare crashes, or accidents involving commercial trucks.

- Insurance bad faith. When insurers deny valid claims, delay payment, or act unfairly in the claims process.

An attorney can step in to gather evidence, manage negotiations, and represent you in court if necessary, ensuring that your claim keeps moving forward when the insurer will not.

Frequently Asked Questions

Q: How long does State Farm take to settle a car accident claim in North Hollywood?

A: Settlement timelines vary depending on the complexity of the accident, the severity of injuries, and whether liability is disputed. While minor property damage claims may resolve in weeks, personal injury claims involving medical treatment and lost wages can take months. If a personal injury lawsuit is filed, the process can extend well beyond a year.

Q: Can I use my health insurance for medical bills while waiting on my State Farm claim?

A: Yes. Many car accident victims use their own health insurance while a claim is pending. If your policy includes MedPay, that coverage may also help with medical expenses. Later, if you receive compensation from State Farm, your health insurer may seek reimbursement through a process called subrogation.

Q: What happens if the driver who caused the crash doesn’t have enough insurance?

A: If the negligent driver’s State Farm policy limits do not cover the full extent of your damages, you may turn to your own policy for Uninsured/Underinsured Motorist (UM/UIM) coverage. California law requires insurers to offer this coverage, though some drivers decline it. UM/UIM can provide compensation for medical expenses, lost wages, and non-economic damages.

Q: Does filing a State Farm claim affect my own insurance rates?

A: If you are filing a third-party claim against another driver’s State Farm policy, your own rates should not be affected. However, if you file a first-party claim under your State Farm policy, for example, using collision coverage or MedPay, your premiums could increase depending on your insurer’s underwriting practices and whether you were at fault.

Q: Should I talk directly to the other driver’s insurance adjuster?

A: Be cautious. Adjusters for the other party’s insurance company work to limit payouts. While you must provide basic information to start a claim, you do not have to give a recorded statement or answer broad questions about your medical history. A personal injury attorney can handle communications with State Farm on your behalf to protect your legal rights.

Q: How long do I have to file a personal injury claim?

A: California law generally gives you two years from the date of injury to file a personal injury lawsuit (Cal. Code Civ. Proc. § 335.1).

Facing Issues With Your State Farm Claim? We Fight Insurance Companies So You Don’t Have to!

At The Shamsi Law Firm, APC, you are never just another case number. Sean Shamsi has been a personal injury attorney for more than 17 years, and he personally handles every case that comes through the North Hollywood office. Clients receive white-glove treatment and the individual attention they expect.

Sean knows how to stand up to big insurance carriers like State Farm. He has recovered millions for clients who were offered lowball settlements or had their claims unfairly denied. From the moment you reach out, he begins investigating your accident, speaking with witnesses, obtaining the police report, and connecting you with the right medical doctors in your area. Clients often say they feel immediate relief once they know Sean is managing the details. He becomes their voice, advocate, and direct liaison with the insurance company.

If you’ve been searching online for “car accident lawyers near me” or need a dedicated lawyer for a car accident, our North Hollywood office is ready to take your call. Schedule your free consultation today at (818) 764-7640(818) 764-7640 or fill out our confidential online form. You pay no attorney fees unless we recover compensation for you.

We fight the insurance companies, so you don’t have to!

Copyright © 2025. The Shamsi Law Firm, APC. All rights reserved.

The information in this blog post (“post”) is provided for general informational purposes only and may not reflect the current law in your jurisdiction. No information in this post should be construed as legal advice from the individual author or the law firm, nor is it intended to be a substitute for legal counsel on any subject matter. No reader of this post should act or refrain from acting based on any information included in or accessible through this post without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue from a lawyer licensed in the recipient’s state, country, or other appropriate licensing jurisdiction.

The Shamsi Law Firm, APC

13209 Saticoy St.

North Hollywood, CA 91605

(818) 764-7640(818) 764-7640

https://www.shamsilaw.com/

No Fee Unless You Win

Questions or Schedule An Appointment? Call Us: (818) 764-7640

Questions or Schedule An Appointment? Call Us:

(818) 764-7640

Related Blog Posts

We Will Fight For You

Our Locations

North Hollywood Office

Get DirectionsAre you struggling and need help from a lawyer? Contact us for a free consultation.

Get a Free Consultation

Required Fields*

Your Information Is Safe With Us

By submitting, you agree to receive text messages at the provided number from The Shamsi Law Firm . Message frequency varies, and standard message and data rates may apply. You have the right to OPT-OUT receiving messages at any time. To OPT-OUT, reply “STOP” to any text message you receive from us. Reply HELP for assistance.

We respect your privacy. The information you provide will be used to answer your question or to schedule an appointment if requested.